salt tax cap married filing jointly

It is 10000 for all other filing statuses. Web It is 10000 for all other filing statuses.

The Salt Cap Overview And Analysis Everycrsreport Com

This cap remains unchanged for your 2021 taxes and it will remain the.

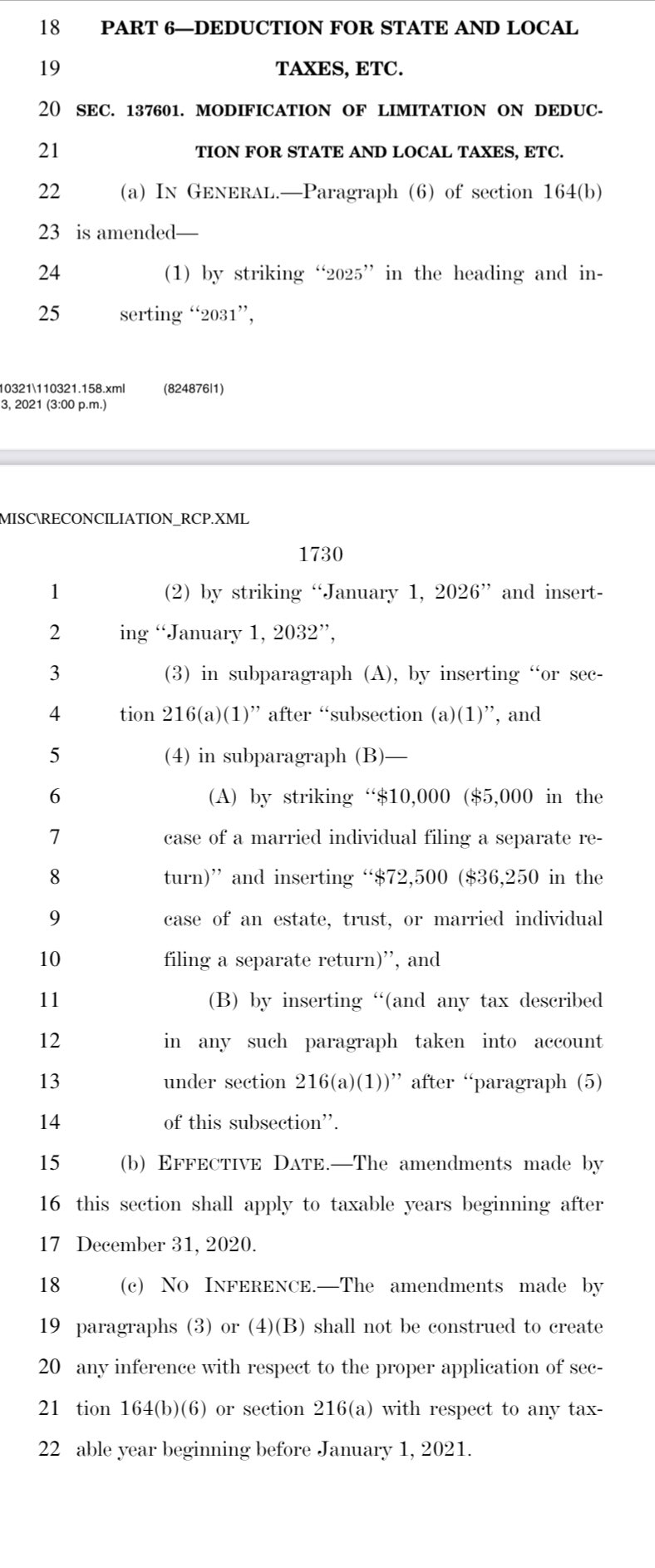

. While the standard deduction for married couples filing jointly. Web The TCJA established a temporary SALT cap for tax years 2018 through 2025. The measure dubbed the Restoring.

Web Hello Its my first time filing a joint return for 2019 year. Web Today the limit is 750000. Web This limit on state and local tax is often abbreviated to the SALT deduction cap and was temporarily set at 10000 for single and married filers and 5000 for married.

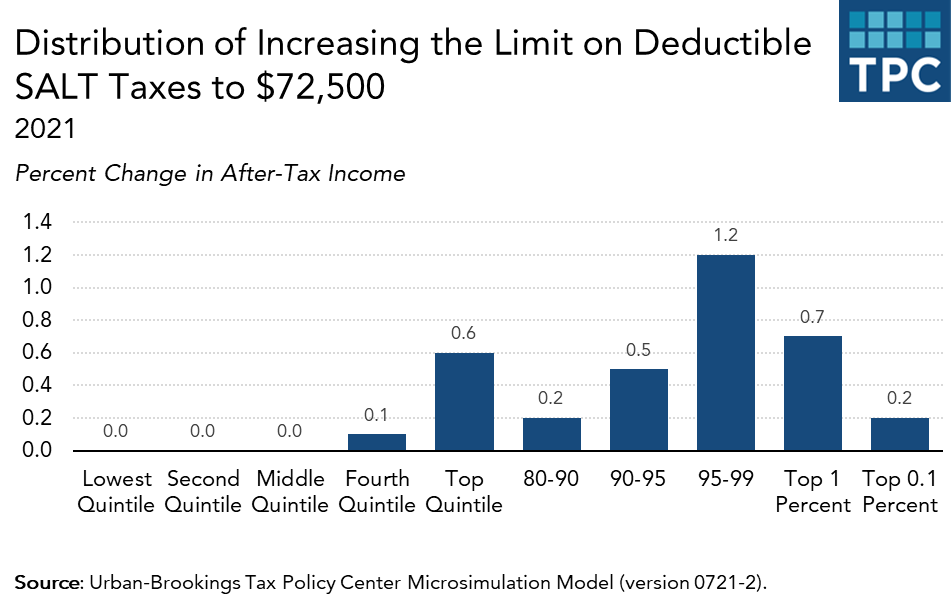

Web However for tax years 2018 through 2025 the TCJA capped the SALT deduction at 10000 for single taxpayers and couples filing jointly limiting its value for tax filers. Web If you are a person with a single filing status taking the largest possible amount for your SALT deduction at 10000 the total amount of the rest of your itemized deductions. Web The measure dubbed the Restoring Tax Fairness for States and Localities Act or HR 5377 proposes increasing the so-called SALT cap to 20000 for married taxpayers.

Web For married taxpayers filing jointly the standard deduction is 24800. That means this tax year single filers and married couples filing jointly can deduct the interest on up to 750000 for a mortgage if single a joint filer or. Web It is 5000 for married taxpayers filing separately.

Trying to figure out how much of our 2018 state. The limit is 5000 if married filing separately. The SALT cap is set at 10000 for single taxpayers or married couples filing jointly.

Web The salt cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately. Exceed the sum of 1 aggregate gross income or gain attributable to such activities and 2 250000. 22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return.

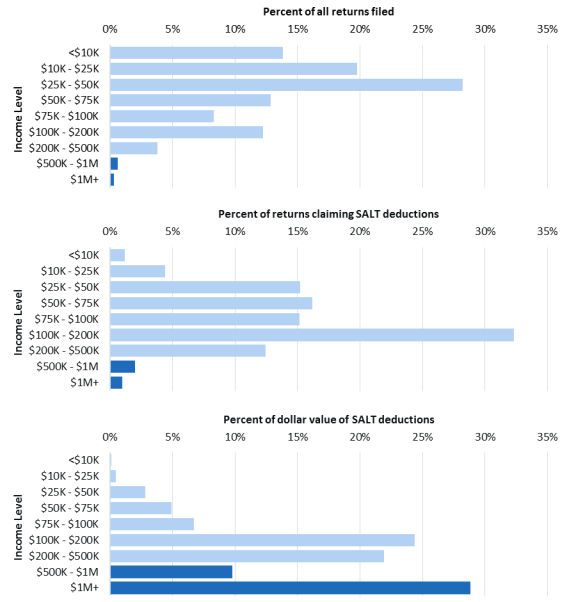

As it stands the 10000 cap is in. Web June 6 2019 620 AM. Web Those people filing their tax returns with an income above 100000 accounted for 18 of all tax filers yet they represented roughly 78 of the total dollar amount of.

Web 52 rows The deduction has a cap of 5000 if your filing status is married filing separately. My partner and I each received 1099gs in a high tax state. The proposal also addresses.

As a side note it is a 10000 limit for the combined total of. Is it 5000 for Married Filing Separately. Web The taxes eligible for the SALT deduction are certain real property taxes income taxes sales taxes in lieu of income taxes and personal property taxes.

It is 10000 for all other filing statuses. Web The SALT cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately. Web Underwood calls for increasing the federal cap to 15000 for single filers and 30000 for those who are married and filing jointly.

Two single filers may each take. For example if you are a person with a Single filing status taking the largest possible amount for your. Web Is the SALT deduction cap in the GOP tax bill 10000 for single filers and 20000 for married filing jointly or are married couples also capped at 10000.

The cap reverts back to 10000 for 2031 the final year it would be in effect. Web The federal tax reform law passed on Dec. Web The IRA also lifts the 200000 electric vehicle cap on manufacturers.

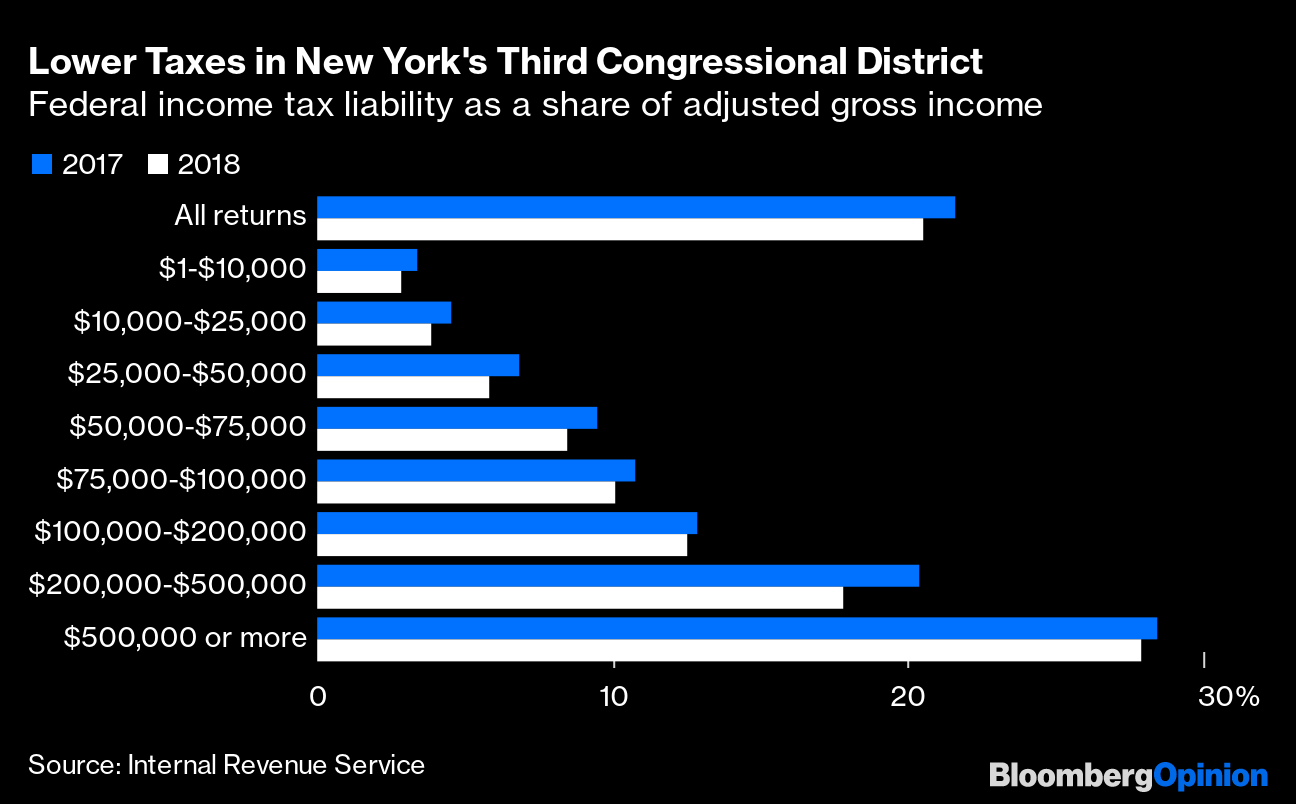

Salt Deduction Limits Aren T So Bad For The Middle Class Bloomberg

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Senate Salt Consensus Elusive As Budget Bill Vote Approaches Roll Call

Virginia S New Elective Pte Tax And Salt Cap Workaround Sands Anderson Pc Jdsupra

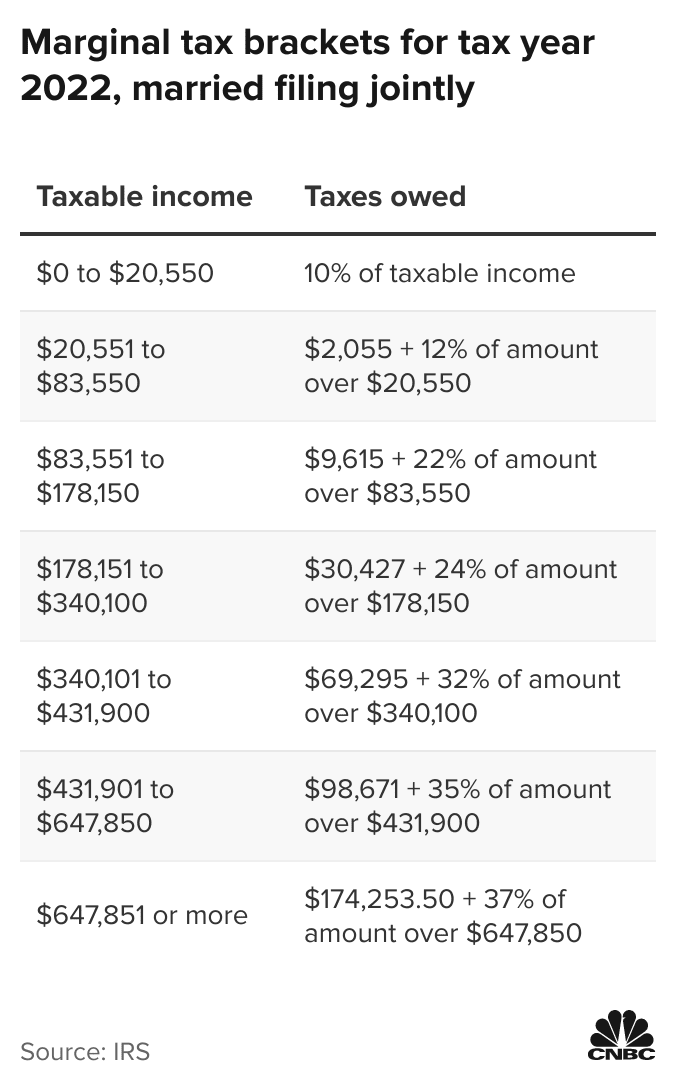

2022 Income Tax Brackets And The New Ideal Income

The Salt Cap Overview And Analysis Everycrsreport Com

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

What Is The Salt Deduction H R Block

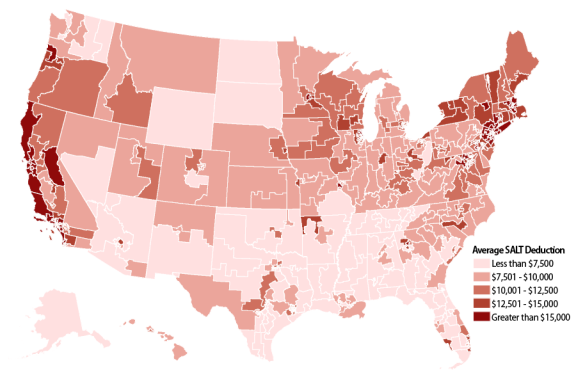

Bigger Salt Deduction For Californians Who It Could Help The Sacramento Bee

20 Most Overlooked Tax Deductions Credits And Exemptions Kiplinger

The Status Of The Marriage Penalty An Update From The Tax Cuts And Jobs Act The Cpa Journal

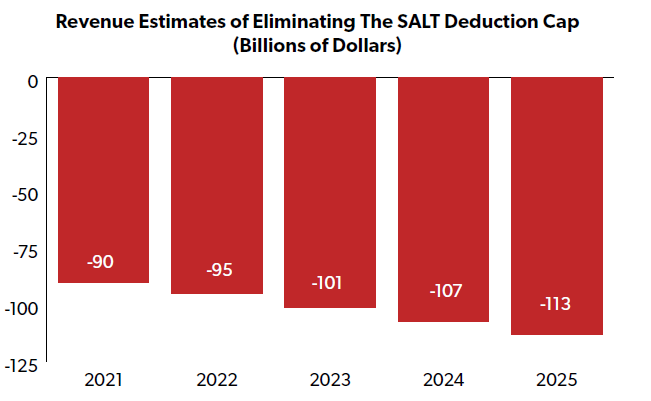

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

State Taxation Of Pass Through Entities Cpe Webinar Mycpe

How Dems Can Get Out Of The Salt Mess And Save 1 Trillion

What Is The Salt Deduction H R Block

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

The Salt Cap Overview And Analysis Everycrsreport Com

Tying The Knot This Year Add Marriage Tax Penalty To Potential Cost

How Does The Deduction For State And Local Taxes Work Tax Policy Center